All Categories

Featured

Table of Contents

[/video]

You can underpay or miss costs, plus you might be able to change your fatality benefit.

Money worth, along with potential development of that worth with an equity index account. An alternative to assign part of the cash money worth to a set rate of interest option.

Is Indexed Universal Life A Good Investment

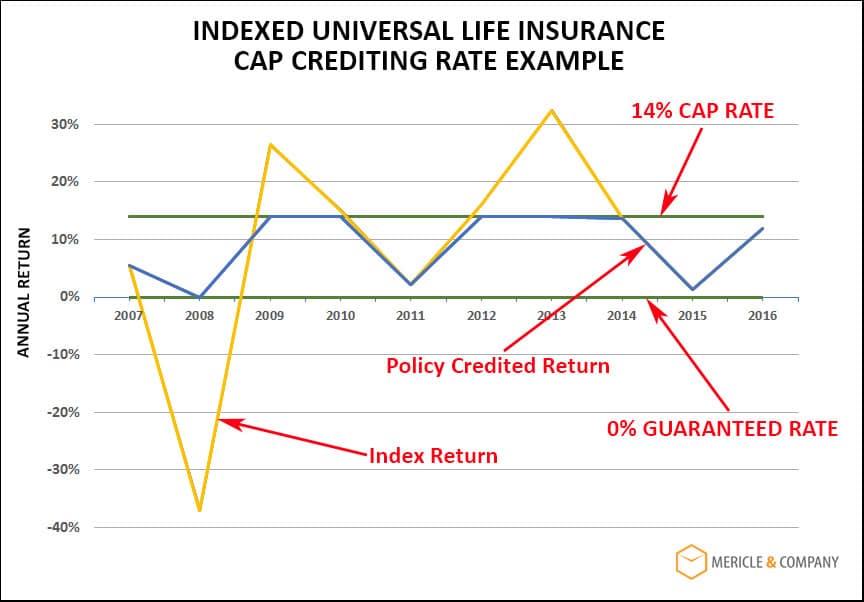

Insurance holders can determine the percentage designated to the taken care of and indexed accounts. The value of the picked index is taped at the beginning of the month and compared with the worth at the end of the month. If the index increases throughout the month, rate of interest is included in the cash money value.

The resulting passion is included to the cash money value. Some plans compute the index gets as the amount of the changes for the duration, while other policies take an average of the daily gains for a month.

Iul Life Insurance State Farm

The rate is set by the insurance provider and can be anywhere from 25% to even more than 100%. (The insurer can additionally change the participate rate over the lifetime of the plan.) If the gain is 6%, the involvement rate is 50%, and the present cash worth total amount is $10,000, $300 is added to the cash money worth (6% x 50% x $10,000 = $300).

There are a variety of advantages and disadvantages to think about prior to buying an IUL policy.: Similar to conventional universal life insurance policy, the insurance policy holder can raise their premiums or lower them in times of hardship.: Quantities credited to the money value grow tax-deferred. The cash money worth can pay the insurance policy costs, allowing the insurance holder to lower or stop making out-of-pocket costs settlements.

Several IUL plans have a later maturity day than other kinds of universal life policies, with some ending when the insured reaches age 121 or more. If the insured is still to life during that time, policies pay out the fatality benefit (yet not usually the cash money worth) and the earnings may be taxable.

Best Equity Indexed Universal Life Insurance

: Smaller sized policy face values do not supply much benefit over routine UL insurance policy policies.: If the index goes down, no interest is attributed to the money value.

With IUL, the objective is to profit from higher movements in the index.: Since the insurance provider only gets alternatives in an index, you're not directly bought supplies, so you don't benefit when companies pay returns to shareholders.: Insurers charge costs for managing your money, which can drain cash money worth.

For many people, no, IUL isn't far better than a 401(k) in terms of saving for retirement. Most IULs are best for high-net-worth individuals searching for means to minimize their taxable earnings or those who have maxed out their other retired life options. For everybody else, a 401(k) is a much better investment lorry since it does not bring the high charges and costs of an IUL, plus there is no cap on the quantity you may earn (unlike with an IUL policy).

While you might not lose any type of money in the account if the index goes down, you won't gain rate of interest. If the marketplace transforms favorable, the earnings on your IUL will not be as high as a normal financial investment account. The high expense of costs and costs makes IULs costly and significantly less economical than term life.

Indexed universal life (IUL) insurance coverage uses money value plus a fatality benefit. The cash in the money worth account can gain interest through tracking an equity index, and with some commonly designated to a fixed-rate account. Indexed universal life plans cap just how much money you can build up (commonly at less than 100%) and they are based on a perhaps unpredictable equity index.

Indexed Universal Life Pros And Cons

A 401(k) is a better alternative for that objective due to the fact that it does not carry the high costs and costs of an IUL policy, plus there is no cap on the quantity you may gain when spent. Most IUL plans are best for high-net-worth people looking for to decrease their gross income. Investopedia does not offer tax obligation, investment, or monetary services and advice.

FOR FINANCIAL PROFESSIONALS We've designed to provide you with the best online experience. Your current web browser might restrict that experience. You may be utilizing an old internet browser that's in need of support, or settings within your web browser that are not compatible with our site. Please conserve on your own some disappointment, and update your web browser in order to view our website.

Currently making use of an updated browser and still having problem? Please provide us a telephone call at for further support. Your current browser: Identifying ...

Iul Life Insurance Reddit

When your selected index gains worth, so as well does your policy's money worth. Your IUL money value will also have a minimum rate of interest that it will always make, no matter market efficiency. Your IUL might likewise have a rates of interest cap. An IUL policy works the same way as a standard universal life policy, with the exception of how its cash worth makes passion.

Chicago Iul

If you're considering acquiring an indexed universal life policy, very first consult with a financial consultant who can clarify the nuances and give you an accurate image of the real potential of an IUL policy. See to it you recognize how the insurer will determine your rate of interest, earnings cap, and costs that could be examined.

Part of your costs covers the plan price, while the rest enters into the cash value account, which can expand based upon market efficiency. While IULs may appear attractive, they normally feature high costs and inflexible terms and are completely inappropriate for numerous investors. They can create rate of interest yet also have the possible to shed money.

Here are some factors that you must take into consideration when identifying whether a IUL plan was ideal for you:: IULs are complicated monetary items. Ensure your broker completely explained just how they work, including the expenses, investment risks, and fee frameworks. There are a lot less costly alternatives available if a death benefit is being looked for by a capitalist.

Equity Indexed Universal Life Insurance Questions

These can substantially reduce your returns. If your Broker stopped working to offer a comprehensive description of the prices for the policy this can be a warning. Know abandonment charges if you decide to terminate the plan early.: The financial investment component of a IUL goes through market fluctuations and have a cap on returns (significance that the insurance policy company obtains the benefit of excellent market efficiency and the financier's gains are topped).

: Ensure you were informed concerning and are able to pay enough costs to keep the policy in pressure. It is critical to extensively research study and recognize the terms, costs, and potential threats of an IUL policy.

Conventional development financial investments can often be combined with much less expensive insurance policy options if a survivor benefit is necessary to an investor. IULs are excluded from federal policy under the Dodd-Frank Act, meaning they are not supervised by the united state Stocks and Exchange Commission (SEC) like stocks and choices. Insurance representatives selling IULs are just required to be certified by the state, not to undertake the same strenuous training as financiers.

Latest Posts

Indexed Universal Life Insurance

Iul Training

Difference Between Whole Life And Iul